Wrapping mechanism

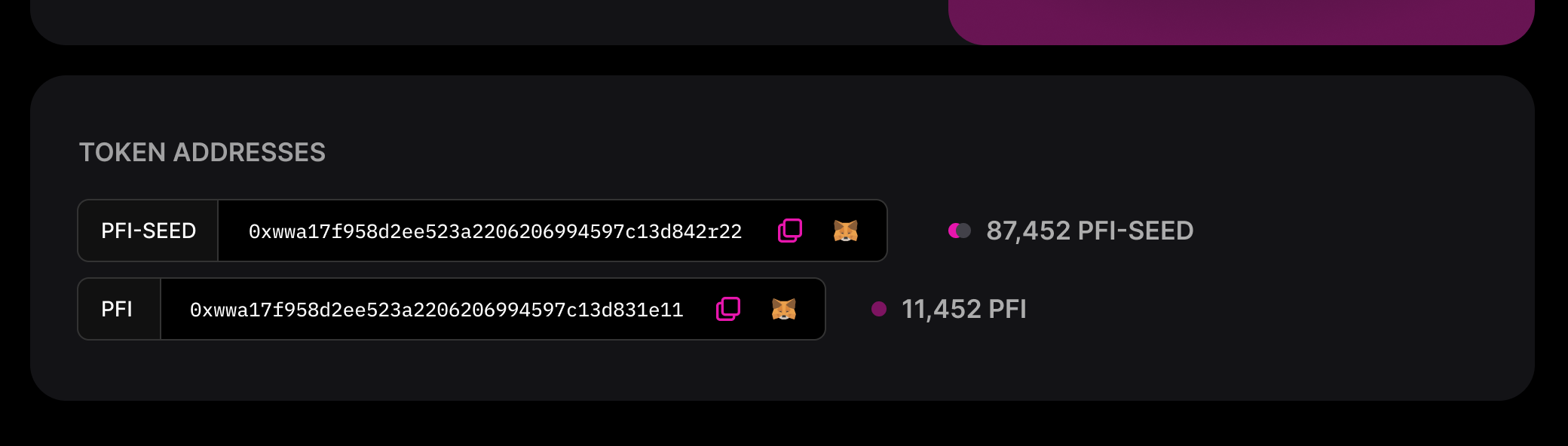

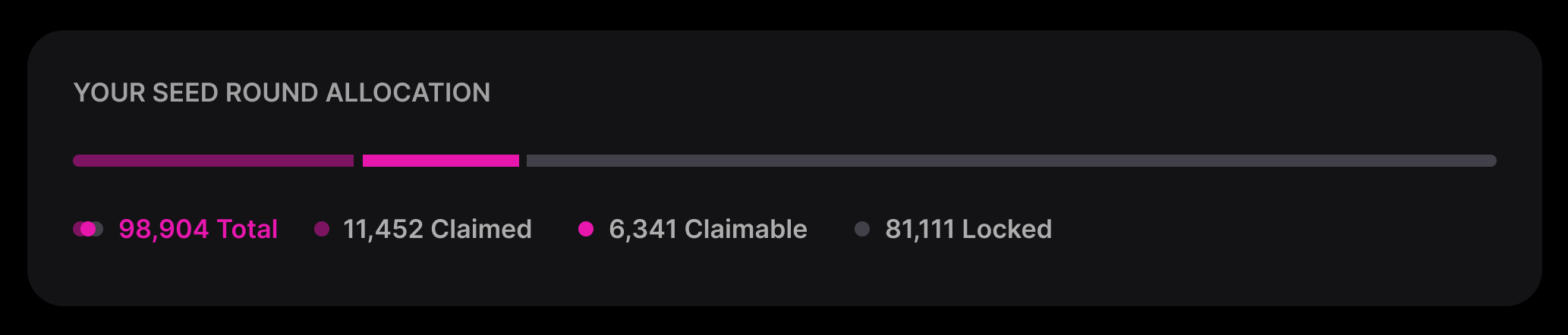

Vesting tokens are ERC20 tokens that represent a claim to your project’s native tokens. These native tokens are locked until the vesting period is complete.

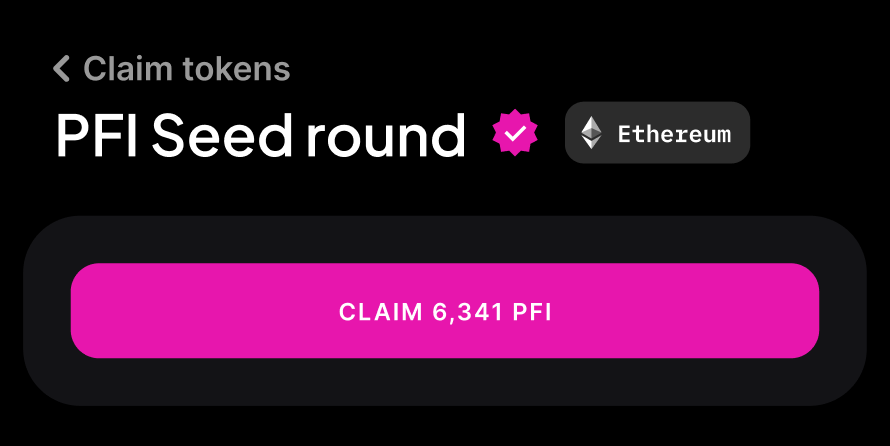

Claiming

Transfers

VestingTokens can be transferred between users while maintaining accurate claimable balances, preventing users from bypassing the vesting schedule by transferring the tokens between wallets. VestingTokens can be bought, sold, and transferred like any other ERC20 token, with a 2.5% protocol transfer fee being routed to the Unvest DAO with every transfer. This fee can be waived for all transfers of a given token with a one-time payment of UNV tokens, which unlocks additional use cases for VestingTokens.Benefits