It is important to ensure that you have already minted your token and that your wallet or multisig holds the entire supply before using the vesting feature.

Using the vesting feature is free for projects, with no fees to lock tokens. You can also use your vesting schedule to distribute unlocked tokens to investors at launch.

Before you deploy:

- Make sure you have minted your token and have the entire supply in your wallet or multisig.

- Know your token supply breakdown, ensure you heave healthy tokenomics.

- Use the vesting feature on test net to familiarize yourself with the tool before your launch date.

- Have a plan for TGE (token generation event) day, what time you’ll add DEX liquidity, send tokens to investors, etc.

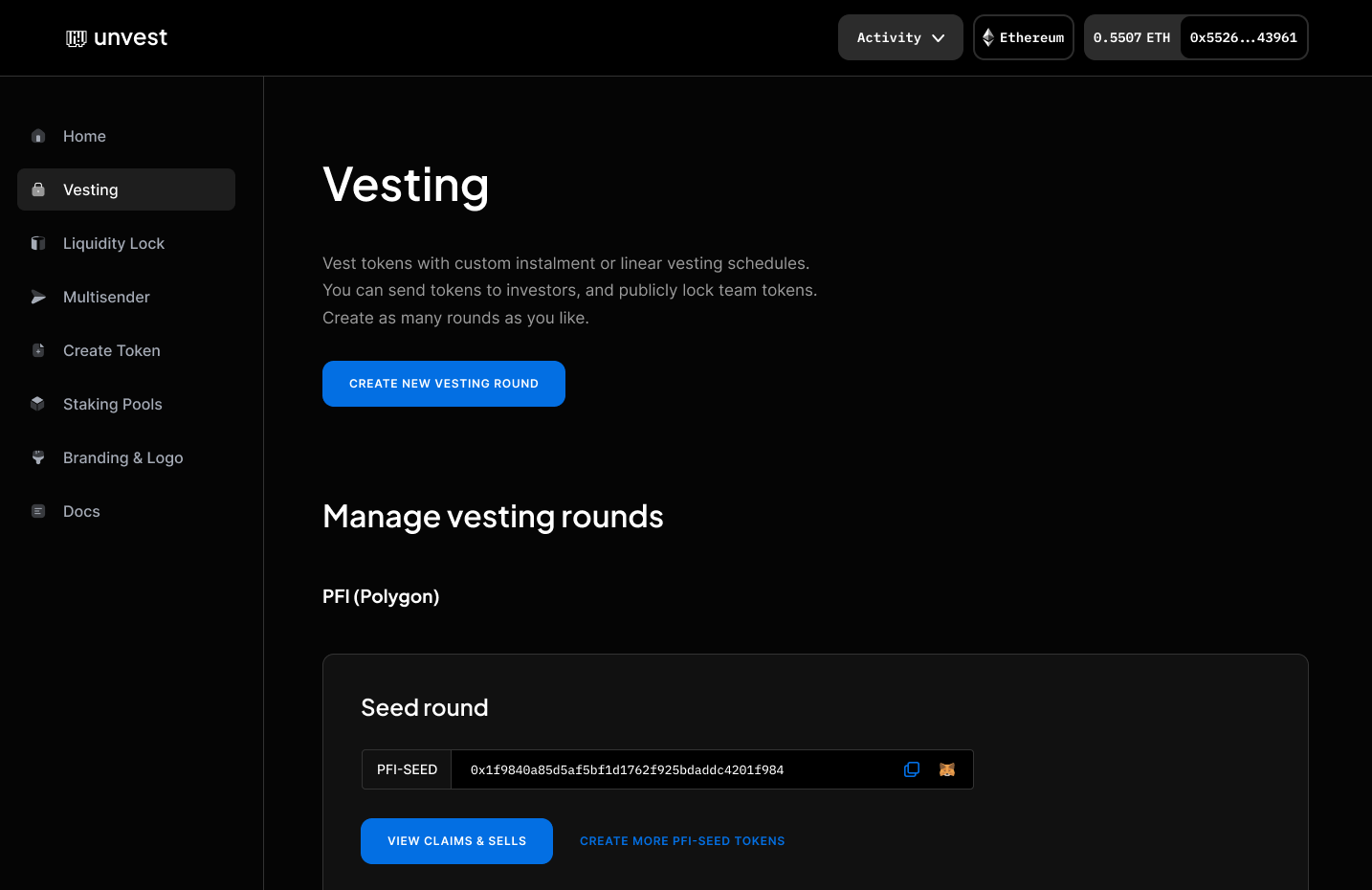

- Know how to deploy a seperate vesting schedule for each investor round, team token allocation, other reserves etc.

- Note that vesting works with any ERC20 on supported networks, but rebase tokens require a workaround and tax tokens require whitelisting the vesting contract.